How Buying a Gutter Machine Qualifies for Section 179 Tax Savings

Posted by Steven on August 29, 2025

If you own a business, particularly a small one, purchasing expensive equipment like a gutter machine can seem like a daunting investment. A gutter machine enables you to manufacture your own gutters, reducing both the time and cost associated with gutter jobs. It also gives you more control over scheduling, customization, and project quality.

Because a gutter machine can gradually increase your profits, it's a worthwhile investment. However, some business owners hesitate due to the high upfront cost. Fortunately, while gutter machines are a significant investment, they can also serve as a valuable tax deduction under Section 179 of the U.S. Internal Revenue Code.

What is the Section 179 Deduction?

Section 179 depreciation allows businesses to deduct the full purchase price of qualifying equipment, like a gutter machine, in the year it is placed into service. The deduction applies to the asset's full value rather than using standard depreciation, even if the equipment is financed. This tax code provision is designed to incentivize small and medium-sized businesses to invest in new equipment and technology, ultimately benefiting both the businesses and the broader economy. It encourages growth and increases your ability to reinvest in operations, staff, or marketing.

How Does Section 179 Work?

Only certain items qualify for the deduction, such as vehicles, office equipment, business machinery, and computers. You can write off up to $1,250,000 beginning in 2025, according to the IRS. However, these rules can change yearly, so it's important to double-check the current limits.

To Qualify for Section 179:

- Your business must be profitable. If your business earns less than what you paid for the gutter machine, you won't be eligible for the deduction.

- However, you may still qualify for bonus depreciation, which allows businesses to deduct 100% of the cost of eligible equipment (new or used) that exceeds the Section 179 limits.

- The gutter machine must be used for business purposes more than 50% of the time.

Additionally, the equipment must be purchased and put into service within the same tax year to qualify. This means planning your purchases before year-end is crucial if you want to maximize your deduction.

Calculating the Section 179 Tax Deduction

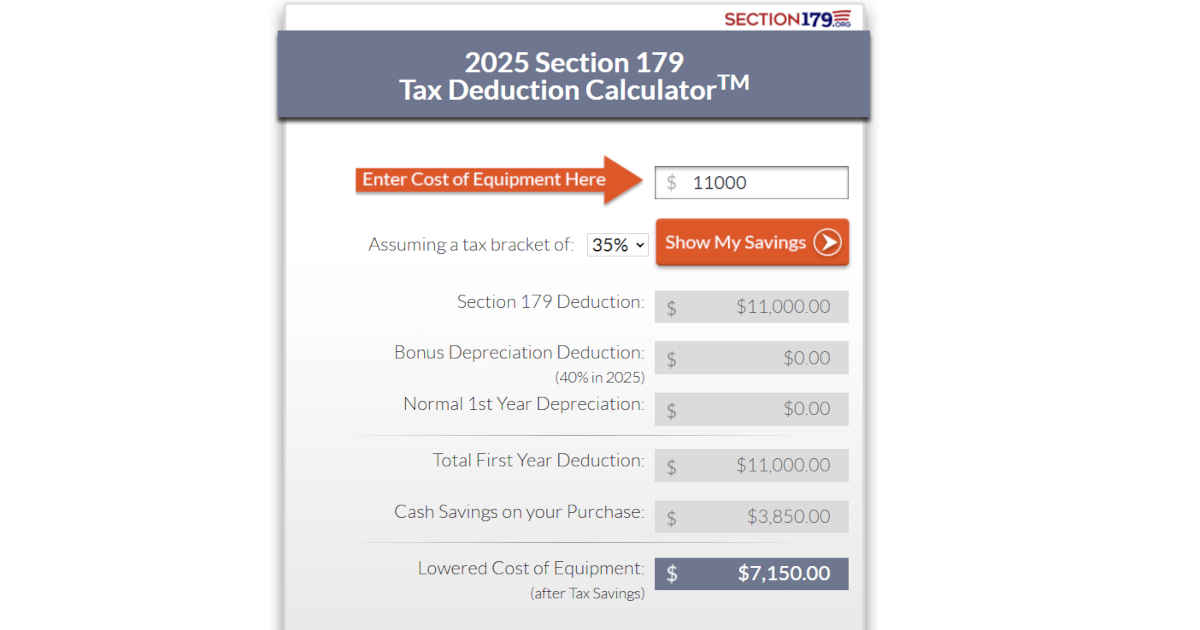

The amount you save depends on your tax bracket. For example, if you're in the 35% tax bracket and purchase a $11,000 gutter machine, your deduction would be $3,850, reducing your net cost to $7,150. When you're running a business, every dollar counts; saving a few thousand dollars in taxes can make a significant difference.

To estimate your potential savings, you can use a Section 179 calculator available online. Consulting with a tax professional is also recommended to ensure you're taking full advantage of the deduction.

Conclusion

Corporations, partnerships, and sole proprietors can all benefit from Section 179. It applies to purchased, leased, or financed equipment, including software. Section 179 is designed to help businesses grow, reduce financial strain, and invest in their futures.

If you're considering buying a gutter machine, Section 179 auto deduction can help ease the financial burden, making it a smart move for your business and your bottom line. It's a way to reduce risk, increase efficiency, and invest in the long-term success of your company.